AI is transforming how institutional investors manage liquidity risks. Here's what you need to know:

- AI tools improve accuracy and efficiency: Achieve up to 95% cash forecasting accuracy, reduce idle cash by 50%, and save 90% of the time spent on scenario analysis.

- Real-time insights: AI provides 100% global cash visibility and adjusts liquidity strategies based on real-time market conditions.

- Stress testing and compliance: AI-powered platforms simulate thousands of scenarios for better risk management and automate regulatory compliance tasks, reducing costs and risks.

- Cross-border management: AI simplifies multi-currency operations, minimizes transaction costs, and ensures funds are available when needed.

Quick Comparison of Top AI Liquidity Tools

| Feature | HighRadius Liquidity Cloud | Amundi ALTO Platform | Kyriba AI Treasury |

|---|---|---|---|

| Forecasting Accuracy | 95% | Portfolio-focused | Limited AI forecasting |

| Implementation Time | 6 weeks | Custom deployment | Longer onboarding |

| Key Strength | Cash flow forecasting | Portfolio liquidity | Bank connectivity |

| Transaction Volume | Not specified | Asset management focus | 3.5 billion transactions |

| Integration Requirements | Minimal | In-house platform | Requires expertise |

AI liquidity tools are reshaping treasury operations by providing real-time insights, automating complex tasks, and enhancing decision-making. Dive into the article for detailed insights and strategies to implement these tools effectively.

AI for Treasury Teams: Improving Cash and Liquidity Oversight with AI and Automation

Key Features of AI-Powered Liquidity Risk Tools

When evaluating AI-powered liquidity risk tools, institutional investors should zero in on features that deliver real, actionable results. The best platforms combine cutting-edge analytics with practical tools, transforming how organizations handle cash positions and manage risk exposure.

Real-Time Liquidity Monitoring

In today’s fast-paced financial environment, real-time liquidity monitoring is a cornerstone of modern treasury management. A recent survey revealed that 62% of CFOs and finance professionals view real-time financial data as essential for maintaining organizational resilience. This underscores the growing demand for instant insight into cash positions across global operations.

Platforms like Trovata exemplify the power of real-time monitoring by automating the collection of data from multiple bank accounts through direct API connections. This eliminates the delays associated with traditional reporting methods and provides immediate visibility into cash movements.

With real-time data, treasury teams can spot liquidity risks before they escalate, enabling timely mitigation strategies. For example, organizations can achieve up to 95% cash forecast accuracy and cut idle cash by as much as 50%.

Jean-Baptiste Gaudemet, SVP of Data and Analytics at Kyriba, highlights the importance of robust data collection:

"The larger your set of historical data is, the better the trained machine learning model will be".

Real-time monitoring also empowers CFOs and treasurers to make informed decisions about investments, borrowing, and cash management - especially during periods of market volatility. Beyond simply offering a snapshot of current liquidity, advanced AI tools can dynamically stress test scenarios, providing deeper insights into potential risks.

Stress Testing and Scenario Analysis

AI has revolutionized stress testing, turning it from a routine compliance task into a dynamic tool for managing risk. Unlike traditional methods that rely on a limited set of historical scenarios, AI systems can generate thousands of scenarios based on both historical data and current market conditions. This allows treasury teams to develop sharper contingency plans and more effective risk strategies.

One major advantage is improved forecasting accuracy. AI-powered models can cut error rates by up to 50% compared to traditional approaches. This level of precision helps institutions better quantify potential impacts and implement stronger risk management measures, leading to more confident liquidity decisions.

In 2024, regulatory stress tests expanded to include exploratory scenarios that assess resilience to emerging risks, such as funding stresses and market disruptions. AI-driven scenario analysis allows treasury teams to simulate a wide range of events - from economic shocks to geopolitical crises - and evaluate their effects on liquidity. This enables proactive planning and more robust responses to unexpected challenges.

Multi-Currency and Cross-Border Management

Managing liquidity across borders brings its own set of challenges, from currency fluctuations to regulatory differences and timing mismatches. AI-powered tools are designed to address these complexities, offering consolidated views of global cash positions. This allows institutions to optimize currency management and avoid liquidity shortfalls.

For example, AI algorithms can analyze market conditions to minimize transaction costs. Nabil Cherrat, Deputy Head of ALTO Product Group at Amundi Technology, explains:

"Market volatility leads to wider Bid-Ask spreads and, consequently, higher transaction costs".

By analyzing market microstructure data, AI can identify the best times to execute transactions, adjusting strategies in real time to reduce costs.

Additionally, AI tools automatically account for variables like time zones, banking holidays, and settlement periods, ensuring that funds are available when needed. Automated cross-border cash pooling further enhances efficiency, making the most of idle cash across multiple currencies and locations. For global treasury operations, this level of automation translates into tangible gains in efficiency and liquidity management.

How to Evaluate AI Liquidity Risk Tools

Choosing the right AI liquidity risk platform involves more than just admiring cutting-edge features. Institutional investors need to dig deeper to determine if a tool aligns with their operational needs and regulatory responsibilities.

Scalability and Integration

A reliable AI liquidity risk tool should manage high transaction volumes and integrate seamlessly with existing systems. This concept of connected liquidity - merging data from treasury management systems (TMS), enterprise resource planning (ERP) systems, banking networks, and analytics hubs - has become a key pillar in modern treasury operations. According to research, organizations that centralize liquidity see a 40% boost in decision-making speed and up to a 30% gain in operational efficiency.

Félix Grévy, VP Product, Open API and Connectivity at Kyriba, highlights how integration drives efficiency:

"API connectivity is the foundation of modern treasury management. It enables real-time data exchange and drives AI-powered insights, empowering finance teams to make faster, more informed decisions. By integrating systems like ERP, TMS, and many other software applications through APIs, businesses can streamline operations, enhance accuracy, and build a truly connected financial ecosystem."

Scalability is equally important. The platform should automatically adapt during peak periods and handle growing data volumes without breaking a sweat. Beyond basic system connections, look for tools that automate manual workflows and simplify data transfers between previously isolated systems. These features enable AI-driven finance strategies, such as predictive insights, fraud detection, and accurate forecasting, while processing massive data sets in real time.

Strong integration capabilities not only improve efficiency but also lay the groundwork for customization and transparency.

Customization and Transparency

Customization is what elevates enterprise-grade platforms. Modern tools often include Explainable AI (XAI) features, which make risk assessments more transparent. While black-box models may deliver high accuracy, their lack of clarity can pose challenges in tightly regulated industries. Explainable models, on the other hand, provide stakeholders with clear insights into how decisions are made - an essential element for meeting compliance and audit requirements.

Prathiba Krishna, AI and Ethics Lead at SAS UK & Ireland, underscores the importance of transparency:

"Transparency is crucial for building trust in AI systems and financial institutions must make AI processes visible and explainable to both customers and regulators."

The best platforms allow for tailoring to your institution’s unique needs, including asset classes, risk tolerance, and regulatory requirements. Look for tools that let you adjust parameters, integrate proprietary risk models, and modify alert thresholds. Additionally, advanced XAI techniques like LIME (Local Interpretable Model-agnostic Explanations) and SHAP (SHapley Additive exPlanations) should be available to clarify individual predictions. Vendors should also provide examples that demonstrate how outputs are generated, showcasing their procedural controls and human oversight.

Once integration and customization are addressed, the focus shifts to regulatory reporting capabilities.

Regulatory Reporting Features

Automating compliance is a must-have feature in any AI liquidity risk tool. By 2029, eight out of ten risk and compliance professionals anticipate widespread AI adoption in this space, yet only 9% of experts were actively using AI as of a 2024 Moody’s survey.

AI simplifies compliance by automating checks for mandates like GDPR and using Natural Language Processing (NLP) to interpret complex regulations, reducing the compliance workload. It can also accelerate traditionally manual audit processes, enabling faster and more efficient reviews.

When evaluating regulatory reporting capabilities, ensure the platform offers comprehensive auditing and documentation of AI processes. A strong compliance strategy should include clearly defined roles, regular testing, human oversight, and detailed records of AI activities. These features are critical for navigating the increasingly complex regulatory landscape with confidence.

sbb-itb-2e26d5a

Top AI Liquidity Risk Tools for Institutional Investors

This section highlights some of the leading AI-driven liquidity risk platforms tailored for institutional investors. With a focus on key features and practical applications, these tools offer valuable insights into managing liquidity risks effectively.

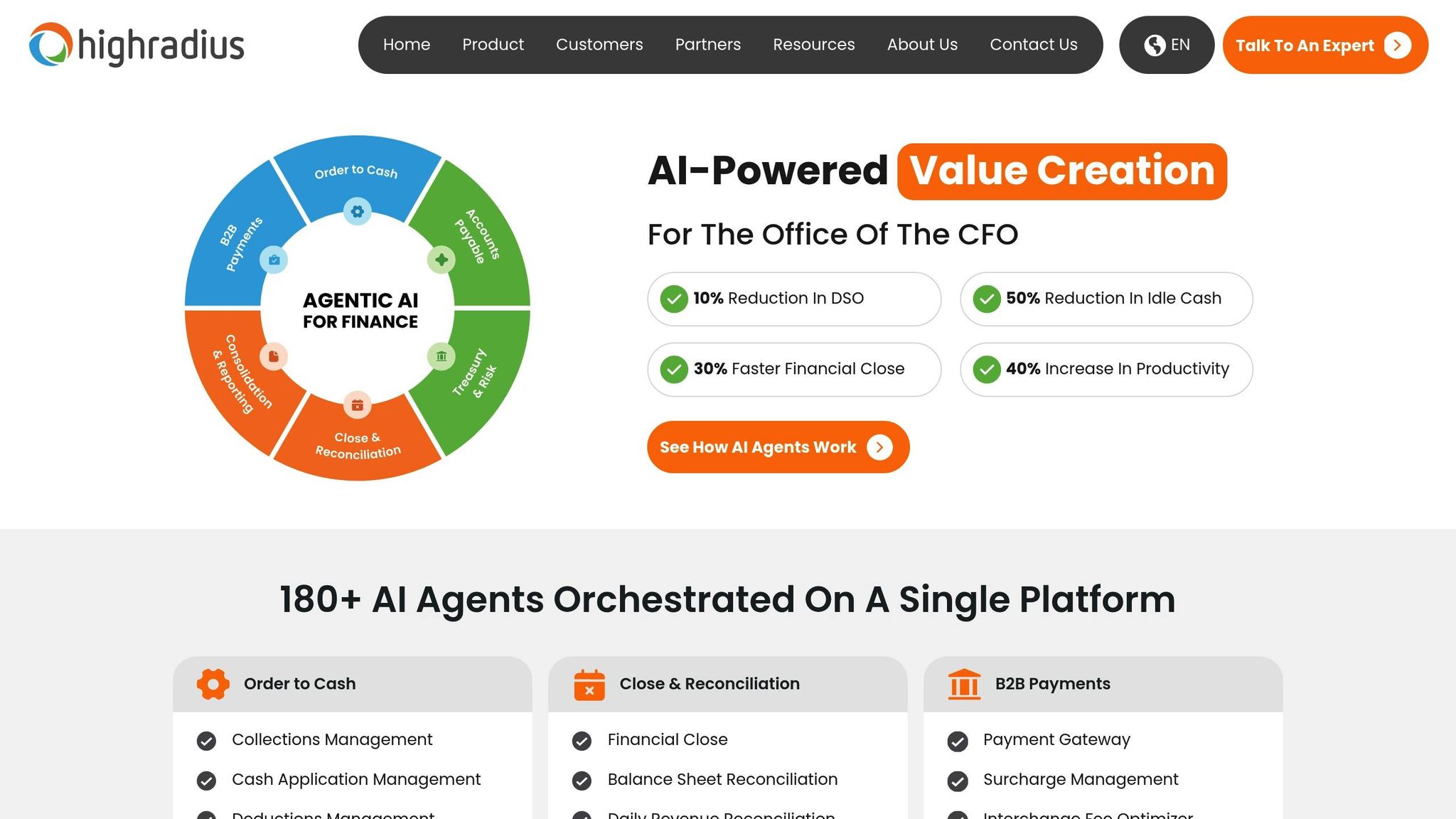

HighRadius Liquidity Cloud

HighRadius Liquidity Cloud stands out with its real-time monitoring and scenario analysis, achieving an impressive 95% cash flow forecast accuracy. This is powered by over 100 machine learning models that help detect anomalies and minimize variances. The platform provides real-time cash visibility and integrates seamlessly with ERP systems, requiring minimal technical support. Its implementation process is quick, taking just six weeks. Companies like Danone, HNTB, Harris, and Konica Minolta have reported significant benefits, including a 70% boost in efficiency and a 50% reduction in idle cash. Additionally, the platform supports comprehensive scenario modeling with API and SWIFT integrations, making it ideal for both best- and worst-case liquidity planning.

Amundi ALTO Platform

The Amundi ALTO Platform is a robust tool for asset management and portfolio liquidity assessment. Developed by Amundi Technology, this platform has been refined over 15 years to integrate investment management, risk evaluation, and operations into a single system. It offers a 360-degree view of portfolios across all asset classes and excels in crisis simulation and stress testing. By leveraging trading-desk data, ALTO helps managers assess potential impacts on liquidation strategies during various market scenarios.

"ALTO is an in-house project that was initiated 15 years ago, designed by Amundi Technology to pool investment management, risks and operations on a single platform."

- Emmanuel ASFAR, Chief Technology Officer, Amundi Technology

Kyriba AI Treasury

Kyriba AI Treasury processes a staggering 3.5 billion bank transactions and manages $15 trillion in payments annually. The platform connects with major banks via APIs and SWIFT, providing real-time global cash balance views and automated reconciliations. While its AI-driven forecasting capabilities are more limited compared to HighRadius, Kyriba excels in treasury automation and bank connectivity.

"AI is rapidly evolving and transforming how the finance industry works, and CFOs expect us to support their data and AI strategy."

- Greg Person, Senior Vice President Sales, Account Management and Alliances, Kyriba

Comparative Overview

Here’s a quick comparison of the three platforms:

| Feature | HighRadius | Amundi ALTO | Kyriba |

|---|---|---|---|

| Forecasting Accuracy | 95% with AI-driven models | Portfolio-focused liquidity | Rule-based with limited AI |

| Implementation Time | 6 weeks | Custom deployment | Longer onboarding required |

| Primary Strength | Cash flow forecasting & ERP integration | Asset management & portfolio liquidity | Bank connectivity & workflow automation |

| Transaction Volume | Not specified | Asset management focus | 3.5 billion transactions annually |

| IT Requirements | Minimal dependency | In-house platform | Requires technical expertise |

Implementation Strategies for AI Liquidity Risk Tools

Introducing AI liquidity risk tools into financial operations requires careful planning, including assessing risks, integrating systems, and training staff effectively. With 72% of organizations adopting AI-driven solutions for asset management and more than 90% of asset managers already utilizing AI technologies, the focus has shifted from deciding whether to use AI to mastering its implementation. However, this process isn't without hurdles - 60% of asset managers cite data integrity risks as a key challenge to AI adoption. By addressing these issues, institutions can maximize the value AI brings.

Data Governance and Security

Strong data governance is the backbone of successful AI implementation. Financial institutions need a cross-functional technology governance structure to oversee the development, testing, and deployment of AI tools. This is especially important as regulators are paying closer attention to security risks linked to poor data management. A solid starting point involves ensuring the use of clean, pre-processed, and diverse data to minimize algorithmic bias.

Organizations should set clear objectives and timelines for their data governance efforts. A T-shaped team approach - combining business leaders with experts in technology and data science - can help create effective benchmarks to track progress. Security measures like authentication, access controls, and encryption are essential. Additionally, institutions must continuously evaluate the reliability of their data sources, particularly external ones, and update privacy policies to reflect the evolving nature of AI-driven data collection and use.

Once AI systems are operational, continuous monitoring is critical. Establishing fallback plans ensures that institutions can respond effectively to system failures.

Addressing Algorithmic Bias

Algorithmic bias is a major concern for institutional investors, with 42% of organizations identifying poor-quality or biased data as a key obstacle to AI adoption. Using diverse training data can help mitigate this issue. Financial institutions should also prioritize interpretable models and deploy explainability tools to enhance transparency in decision-making. This is crucial because AI algorithms often operate within complex systems, making them harder to understand compared to traditional models.

Human oversight is indispensable for validating AI outputs. Comprehensive testing protocols should be implemented at every stage of the AI lifecycle. Extensive testing, along with solutions that provide detailed performance metrics, enables users to understand how AI systems reach their conclusions. Once governance and unbiased systems are in place, the next step is equipping teams with the skills needed to integrate AI effectively.

Training Treasury Teams

The rapid rise in AI adoption - from 45% in 2022 to a projected 85% by 2025 - underscores the need for targeted training for treasury teams. With 60% of companies employing AI across various business areas, treasury professionals must adapt to this changing landscape. Training programs should focus on three key areas: data analysis and interpretation, effective use of AI tools, and ethical considerations in AI applications. This approach allows treasury teams to shift their focus from routine tasks to strategic and analytical work.

Bridging the skills gap can be achieved through specialized recruitment and training programs. Starting with a pilot program can assess an organization’s readiness for AI and identify integration challenges early on. These pilot initiatives give teams hands-on experience and help address potential issues before full-scale implementation. Comprehensive training programs tailored to financial professionals should cover AI fundamentals and their practical applications.

Mandana Sadigh, Treasurer at Mattel, highlights the strategic nature of treasury roles despite advancements in AI:

"While I have a lot of respect for systems like artificial intelligence and robotics, I do not consider treasury operations as purely an activity-based role... It is a strategic role requiring one to dig into the business and understand it... Your insight as an individual makes a difference."

This sentiment is echoed by Janet Legge, Deputy Chief Executive at ACT, who emphasizes the importance of continuous learning:

"In the world of AI transforming everyday, corporate treasurers need to be upskilled."

Success in implementation relies on phased rollouts, regular feedback, interactive training workshops, and clear escalation procedures to address challenges as they arise.

The Future of AI in Liquidity Risk Management

AI is poised to reshape liquidity risk management for institutional investors. With 98% of CEOs agreeing that AI and machine learning can deliver immediate benefits to businesses, the financial sector is entering a new era where technology will redefine how institutions tackle liquidity challenges.

Key Benefits of AI Liquidity Tools

AI-driven tools are revolutionizing critical liquidity functions, improving portfolio performance by 27%, and offering actionable insights to navigate market and regulatory changes.

One major advantage is Enhanced Decision-Making Capabilities. AI systems can process enormous amounts of data in real time, delivering insights essential for staying ahead of market trends and meeting regulatory demands. For instance, a pension fund using a proprietary generative AI model significantly improved its research and risk assessment processes. By analyzing both internal and external data, the fund adopted innovative investment strategies and quantified risks more effectively. Within just a year, this approach differentiated its performance and streamlined decision-making.

AI also drives Operational Efficiency Gains by automating routine tasks. This not only increases productivity but also allows professionals to focus on high-value strategic work. As Matt McManus, Head of Finance at Kainos Group, puts it:

"AI and ML free accounting teams from manual tasks and support finance's effort to become value creators".

Another critical area is Regulatory Compliance Improvements. AI enables real-time monitoring and automated reporting, helping institutions stay compliant while reducing the manual workload. With 52% of business leaders already using AI for risk modeling and over 60% leveraging it for cybersecurity threat detection, the potential for streamlined compliance processes is clear.

These advancements are only the beginning, with emerging technologies set to redefine these benefits further.

Emerging Trends to Watch

The next decade will bring several technological trends that promise to enhance AI-powered liquidity risk management even further:

- Quantum Computing Integration: Financial institutions are exploring quantum technology to solve complex optimization problems, improving portfolio efficiency.

- Advanced Natural Language Generation: This technology will change how institutions communicate with clients and report internally. Voice AI systems, for example, will offer personalized explanations and real-time translations of complex financial concepts.

- Federated Learning for Privacy: Addressing growing concerns about data security, federated learning allows AI to learn from decentralized data sources without centralizing sensitive information. This approach supports data privacy regulations while maintaining the benefits of collaborative AI models.

- Blockchain Integration: Blockchain technology introduces immutable audit trails and smart contracts, automating compliance and increasing transparency in liquidity management.

As these innovations converge with traditional liquidity management practices, they open up new possibilities for institutions willing to invest in comprehensive AI strategies. However, there’s a note of caution. Adam Sharp, Research Director at HIVE Blockchain Technologies LTD, warns:

"There's a very real risk of herding reactions if everyone is trading off similar analysis".

This underscores the importance of developing unique AI capabilities tailored to an institution’s specific needs, rather than relying solely on standardized solutions. Combining AI with expert human oversight will be crucial for driving success in future liquidity management.

FAQs

How do AI-powered liquidity risk tools improve decision-making for institutional investors?

AI-driven tools for managing liquidity risks are transforming how institutional investors make decisions. These tools provide real-time insights and data-backed predictions, addressing gaps that traditional methods often leave unfilled. By using machine learning to process massive amounts of market data, they help uncover trends, flag potential risks, and streamline liquidity management.

With continuous monitoring of market dynamics and historical data, AI can spot liquidity challenges early. This allows investors to take proactive steps to reduce risks, enabling more accurate portfolio adjustments, well-timed transactions, and readiness for market fluctuations. The result? Smarter, more confident investment choices.

What should institutional investors look for in an AI-powered liquidity risk platform for cross-border operations?

When selecting an AI-powered liquidity risk platform for cross-border operations, institutional investors should pay close attention to a few key features. Real-time insights and predictive analytics are crucial for staying ahead of market fluctuations and managing risks with precision. Tools like advanced machine learning and cash flow forecasting can help institutions navigate shifting market dynamics while ensuring liquidity remains intact.

The platform should also address the complexities of complying with diverse regulatory frameworks across multiple jurisdictions - an essential factor in cross-border transactions. Compatibility with existing systems is another must-have, along with features such as cost management and fraud detection to boost efficiency and reduce exposure to risks. Focusing on these aspects can help deliver a dependable and effective solution for navigating the demands of global financial operations.

How do AI tools help institutional investors stay compliant with changing liquidity risk regulations?

AI tools play a crucial role in helping institutional investors navigate the ever-changing landscape of liquidity risk regulations. These tools automate essential compliance tasks and provide real-time monitoring, making it easier to keep up with regulatory changes. They can pinpoint potential compliance issues and simplify the often-complex reporting process.

By processing massive amounts of data, AI supports adherence to standards such as Basel III while offering ongoing insights into market trends and internal risk exposures. This forward-thinking approach allows institutions to stay on top of compliance requirements in a constantly shifting regulatory environment.