Managing order flow data across multiple platforms can be tough. The right tools simplify this by consolidating and processing data in real time, making trading decisions faster and more informed. Here are five tools that stand out for their ability to handle order flow data:

- Estuary Flow: Real-time streaming with pre-built connectors and strong security.

- Fivetran: Automates data syncing with near real-time updates and schema drift handling.

- Apache NiFi: Open-source with flexible customizations and real-time data flow control.

- Rivery: Cloud-native, offering user-friendly setup and micro-batching for real-time use.

- Pentaho: Focuses on batch processing with extensive integration options.

Quick Comparison

| Tool | Real-Time Processing | Multi-Platform Support | Ease of Use | Security Features | Pricing Model |

|---|---|---|---|---|---|

| Estuary Flow | Yes | Excellent | Moderate | Advanced encryption | Usage-based |

| Fivetran | Near real-time | Strong | High | SOC 2, role-based access | Connector-based |

| Apache NiFi | Yes | Flexible | Requires expertise | SSL/TLS, role-based access | Free (open-source) |

| Rivery | Near real-time | Broad | High | AES-256, audit logs | Tiered pricing |

| Pentaho | Limited | Good | Moderate | LDAP, audit logging | Enterprise licensing |

Each tool has strengths tailored to different trading needs. If you prioritize real-time updates, consider Estuary Flow or Apache NiFi. For ease of use, Fivetran or Rivery may suit you better. Choose based on your trading strategy and technical requirements.

1. Estuary Flow

Estuary Flow is a platform designed for real-time data streaming, specifically tailored to integrate order flow data from multiple trading platforms. Its core strength lies in handling high-volume data streams with reliability and efficiency. Here's a closer look at how it tackles the challenges of order flow data integration:

Real-time Data Processing

Using change data capture (CDC) technology, Estuary Flow processes new order flow data as it happens. This ensures users receive up-to-the-minute updates on market activity, keeping them ahead of rapid changes.

Multi-Platform Compatibility

The platform is built to work seamlessly across a variety of trading platforms and data providers. It automatically adjusts to changes in data formats, eliminating the need for manual reconfigurations and saving valuable time.

Extensive Data Connectors

Estuary Flow simplifies integration with its library of pre-built connectors and support for standard protocols like REST APIs and WebSocket. This allows users to effortlessly merge real-time order flow with historical data and portfolio management systems.

Security and Compliance

Given the highly sensitive nature of trading data, Estuary Flow prioritizes robust security. It employs advanced encryption, enforces role-based access controls, and maintains detailed audit trails. These features ensure operations remain secure and compliant with industry standards.

2. Fivetran

Fivetran, much like Estuary Flow, uses automation and powerful connectivity to streamline fragmented order flow data. It’s a cloud-based data integration platform designed to automate the syncing of order flow data across systems, while also handling schema drifts with ease. By automating data pipeline management, Fivetran minimizes the manual work typically involved in maintaining trading data integrations.

Multi-Platform Compatibility and Data Connectors

Fivetran supports a broad array of data connectors, making it a go-to option for traders using multiple systems. It integrates seamlessly with trading applications, market data providers, and financial databases. The platform’s ability to detect and adapt to schema drifts ensures that changes in data structures don’t disrupt operations. As a result, order flow data from various sources arrives in your analytics tools with consistent field names and data types.

Its extensive library of connectors covers a wide range of data sources, including key players in financial markets such as market data providers and cryptocurrency exchanges. Whether handling batch or incremental data loads, Fivetran focuses on transferring only new or updated records, ensuring both efficiency and reliability. This comprehensive support is paired with robust security measures.

Security and Compliance

Security is a top priority for Fivetran, especially given the sensitive nature of trading data. The platform includes audit logs to track data movements and role-based access controls to manage who can access specific data. For organizations with strict data isolation requirements, Fivetran also offers features that enhance network security, ensuring compliance with key industry standards.

Real-Time Data Processing

Fivetran has stepped up its game with low-latency synchronization for supported connectors. Its intelligent scheduling system automatically adjusts sync frequency based on data volume and source availability, making it ideal for active trading strategies. This approach balances performance and cost, ensuring real-time insights without unnecessary overhead.

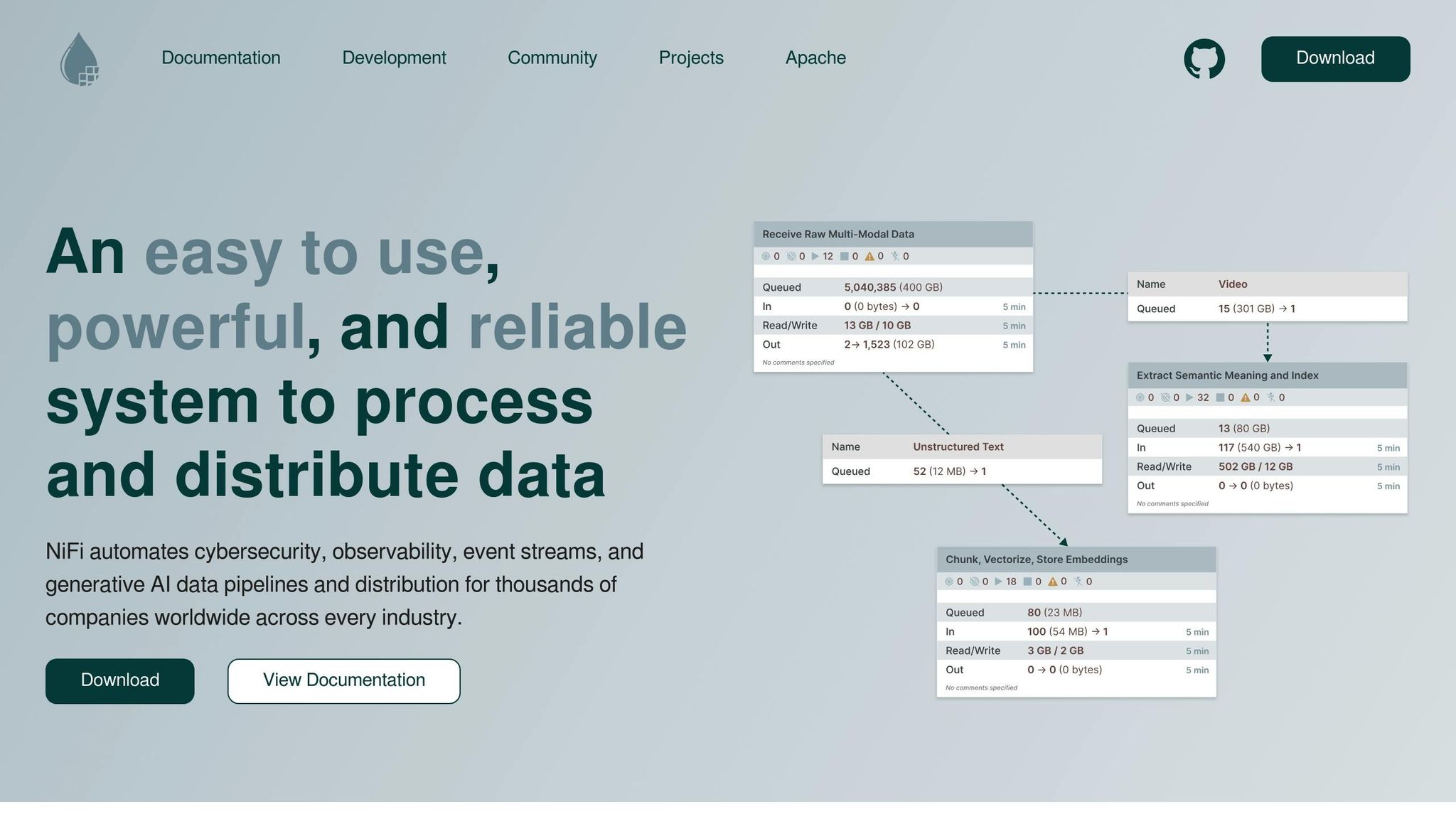

3. Apache NiFi

Apache NiFi stands out as a powerful open-source tool for designing and managing data flows, bringing a fresh approach to handling fragmented order flow data. With its intuitive visual interface, NiFi makes it easier to build and customize pipelines with minimal coding, making it an appealing option for managing complex data flows across platforms.

Multi-Platform Compatibility

NiFi connects effortlessly with a variety of systems, including REST APIs, databases, messaging platforms, and file systems. Its built-in transformations ensure consistent data handling, making it a reliable bridge between older legacy systems and modern analytics tools. This versatility lays the groundwork for smooth, real-time data processing.

Real-Time Data Processing

One of NiFi's standout features is its ability to process data in real time. By using back-pressure mechanisms, it can handle large data volumes without overwhelming the system. This real-time processing is crucial for analyzing order flow, where timely insights directly influence trading decisions. NiFi also offers provenance tracking, which provides a clear audit trail for compliance and troubleshooting. Additionally, its clustering support allows for horizontal scaling to manage increasing data demands.

Wide Range of Data Connectors

NiFi supports a variety of data formats through its built-in processors and even allows users to develop custom Java processors for proprietary systems. Its content-based routing feature ensures that data is delivered only to the systems that need it, based on predefined criteria, streamlining the entire process.

Security and Compliance

Security is a priority with NiFi. It includes SSL/TLS encryption, role-based access control, and detailed data lineage tracking to meet regulatory requirements. The platform also integrates with enterprise authentication systems like LDAP and Kerberos. For organizations with stringent compliance needs, NiFi can be deployed in secure, isolated environments, ensuring data integrity and protection.

4. Rivery

Rivery stands out by blending simplicity with real-time processing capabilities. Designed for modern data ecosystems, it offers a cloud-native solution that simplifies integrating order flow data across multiple platforms. With a focus on user-friendly features and scalability, Rivery is an appealing choice for traders who need dependable data solutions without dealing with complex technical setups.

Multi-Platform Compatibility

Rivery shines when it comes to connecting various trading platforms. It offers pre-built connectors for major trading APIs, databases, cloud storage, and data warehouses. This broad compatibility allows traders to seamlessly pull order flow data from their primary platforms and feed it directly into analytics tools or backup systems.

Its no-code, drag-and-drop interface makes setup fast and straightforward. This feature is especially useful for trading teams that operate in fast-moving markets, as it minimizes implementation time. Combined with its extensive connectivity options, Rivery ensures smooth and efficient real-time data delivery.

Real-Time Data Processing

Rivery employs Change Data Capture (CDC) and micro-batching to provide near real-time updates across systems.

With micro-batching, the platform groups related data into small batches instead of processing each data point individually. This method reduces system strain while maintaining near real-time performance. It’s particularly valuable during peak trading periods, where order flow data volumes can surge. This balance between speed and stability makes Rivery a reliable choice for handling high-frequency data demands.

Breadth of Data Connectors

Rivery goes beyond standard trading data by integrating with alternative sources like social media, news APIs, and economic data. It also supports custom REST API connections, enabling traders to incorporate proprietary data or connect to less common platforms.

The platform’s data transformation engine automatically resolves inconsistencies between different systems. For instance, it can standardize timestamp formats from various exchanges or normalize currency values, ensuring uniform data quality. Built-in validation rules further enhance reliability by flagging anomalies or missing data points before they can impact trading decisions.

Security and Compliance

Rivery prioritizes data security with AES-256 encryption, SOC 2 Type II certification, role-based access controls, and detailed audit logs. These features meet the strict compliance standards required in the financial sector. For firms navigating complex regulations, Rivery’s robust documentation and secure handling processes provide peace of mind and simplify compliance reporting.

sbb-itb-2e26d5a

5. Pentaho

Pentaho, developed by Hitachi Vantara, is a well-established data integration platform centered around its ETL engine, Pentaho Data Integration (PDI). It brings together data from multiple sources, making it a practical choice for managing order flow data within trading environments.

Multi-Platform Compatibility

Pentaho stands out for its ability to tackle multi-platform order flow challenges by offering a wide range of connector options. These include connectors for major databases like Oracle, SQL Server, MySQL, and PostgreSQL, as well as for leading cloud platforms such as Amazon Web Services, Microsoft Azure, and Google Cloud Platform. Its architecture is designed to be flexible, allowing users to create custom integrations for specific trading systems or broker APIs. This ensures seamless consolidation of data from various sources.

The platform's Kettle engine simplifies complex data transformations, such as schema mapping and data type conversions. This capability helps streamline the integration of order flow data from diverse systems.

Real-Time Data Processing

While Pentaho is widely recognized for its batch processing capabilities, its PDI engine also supports continuous data flows for near-real-time processing. This feature is particularly valuable in trading operations, where quick access to updated data can make a significant difference.

Extensive Data Connectors

Pentaho offers a rich set of pre-built connectors and allows for the creation of custom integrations. Its metadata injection feature further enhances flexibility by enabling dynamic pipeline adjustments, letting users modify connections and transformation logic as needed.

Security and Compliance

Pentaho prioritizes enterprise-grade security with features like role-based access controls, LDAP integration, and audit logging. These tools provide clear data lineage, which is crucial for meeting regulatory requirements and managing risks effectively.

Feature Comparison Table

The table below offers a detailed side-by-side comparison of key tools for multi-platform trading. It highlights their strengths, limitations, and suitability for various trading environments.

| Tool | Multi-Platform Support | Real-Time Processing | Connector Breadth | Security Features | Scalability | Pricing Model | Limitations |

|---|---|---|---|---|---|---|---|

| Estuary Flow | Excellent native support for major trading platforms and cloud services | Real-time streaming | Pre-built connectors, including specialized trading APIs | Advanced encryption, role-based controls, audit trails | Auto-scaling cloud architecture | Usage-based pricing | Limited customization for complex transformations |

| Fivetran | Strong focus on SaaS and cloud platform integrations | Near real-time data synchronization | Connectors with automated schema management | SOC 2 Type II compliant with field-level encryption | Horizontal scaling with automatic resource allocation | Connector-based pricing | Costs increase with high-volume data |

| Apache NiFi | Open-source flexibility for custom integrations | Real-time streaming with configurable flow control | Processor library supporting custom development | Kerberos authentication, SSL/TLS encryption, provenance tracking | Clustered deployment with load balancing | Free (open-source) with optional enterprise support | Requires technical expertise for setup and maintenance |

| Rivery | Focus on cloud data warehouses and business applications | Supports both real-time and scheduled processing | Connectors focused on business intelligence sources | Enterprise security including data masking and encryption | Cloud-native with automatic scaling | Tiered pricing | Limited support for legacy trading systems |

| Pentaho | Support for databases and cloud platforms | Near real-time via batch optimization | Rich connector ecosystem with custom integration capabilities | LDAP integration, role-based controls, audit logging | Scalable architecture with distributed processing | Enterprise licensing with volume-based pricing | Primarily batch-focused with limited streaming capabilities |

This comparison underscores the key attributes of each tool. Below is a closer look at critical factors that differentiate them.

Pricing Models

Pricing structures vary significantly. Estuary Flow and Rivery adopt consumption-based pricing, offering flexibility for businesses that scale usage up or down. On the other hand, Fivetran uses a connector-based model, which can lead to higher costs as the number of integrations grows. Apache NiFi stands out as a cost-effective option, being open-source, though it requires more technical expertise for setup and maintenance.

Real-Time Processing

Real-time data handling is a major factor in choosing the right tool. Estuary Flow and Apache NiFi excel in real-time streaming, making them ideal for high-frequency trading scenarios. Fivetran, while not offering true real-time processing, provides near real-time synchronization that works well for trading analytics. Meanwhile, Pentaho focuses on batch optimization, which is better suited for complex data transformations rather than immediate data processing.

Connector Ecosystems

The breadth and functionality of connectors also play a crucial role. Fivetran simplifies integration with pre-built connectors and automated schema detection, reducing setup time. Apache NiFi, with its processor-based architecture, offers unmatched customization for integrating with diverse systems. Estuary Flow strikes a balance, delivering optimized connectors tailored for real-time data flows.

Security and Technical Resources

Security is critical in trading environments, and all tools meet enterprise-grade standards, though their approaches differ. For example, Apache NiFi uses Kerberos authentication and SSL/TLS encryption, while Rivery incorporates data masking and advanced encryption. However, technical resource requirements vary widely. Apache NiFi demands significant expertise but offers unmatched flexibility, whereas Fivetran and Rivery are designed for user-friendly experiences with minimal technical complexity.

Each tool has its strengths and trade-offs, making the choice dependent on specific business needs, whether it's real-time processing, ease of use, or scalability for managing order flow data across platforms.

Conclusion

Selecting the right order flow tool can make all the difference in streamlining multi-platform trading. Each of the five tools we've reviewed brings something unique to the table.

- Estuary Flow stands out for real-time streaming capabilities.

- Fivetran is ideal for those seeking a straightforward, user-friendly experience.

- Apache NiFi offers unmatched flexibility for complex workflows.

- Rivery shines with its cloud-native performance.

- Pentaho remains a reliable choice for handling intricate batch transformations.

When deciding, think about your budget, the skill level of your technical team, and the platforms you need to connect. If real-time processing is a priority, tools like Estuary Flow or Apache NiFi might be your best bet.

Scalability is another factor to keep in mind. A tool that handles 10,000 transactions per day may not perform as well at 100,000 unless its architecture is built to scale. Your decision today will impact both your current operations and your ability to grow in the future.

For more in-depth comparisons and reviews of trading tools, check out the Best Investing Tools Directory at https://bestinvestingtools.com. This resource covers a wide range of trading software, charting tools, and technical analysis platforms, helping both individual and institutional investors make informed choices.

Choosing the right order flow tool ensures seamless data integration and positions your trading strategy for long-term success.

FAQs

How can I choose the best order flow data tool for my trading strategy and skill level?

Choosing the best order flow data tool comes down to your trading style, experience, and the features you prioritize. If you're an advanced trader zeroing in on intraday or short-term strategies, platforms like Bookmap, Sierra Chart, or NinjaTrader are worth exploring. These tools offer detailed, real-time insights into market activity, which can be invaluable for making precise decisions.

For those just starting out or who prefer simplicity, look for platforms with a more straightforward design. Many beginner-friendly tools focus on essential features like basic volume profiles and easy-to-navigate interfaces, making them less daunting for new traders.

The key is to pick a tool that matches your trading goals, technical skills, and budget. The right choice should help you make more informed decisions without adding unnecessary complexity.

What is the difference between real-time and near real-time data processing, and how does it affect trading decisions?

Real-time data processing involves analyzing information the moment it's generated, often within milliseconds. This level of speed is crucial for activities where timing is everything, such as high-frequency trading (HFT). In HFT, even the tiniest delays can mean the difference between making a profit or missing out. By using real-time data, traders can respond instantly to market fluctuations, capitalizing on fleeting opportunities and reducing the risk of slippage.

On the other hand, near real-time data comes with a small delay - usually just a few seconds or minutes. While it’s not as immediate, this approach works well for trading strategies that aren’t as time-sensitive. It also allows for more thorough data storage and analysis. That said, in fast-paced markets, even slight delays can impact precision and, ultimately, the success of a trade.

What key security features should I look for in an order flow data tool for multi-platform trading?

When selecting an order flow data tool for trading across multiple platforms, make security your top priority. Look for tools that use data encryption protocols like SSL or TLS to keep transmissions secure and implement robust access controls to prevent unauthorized access. These are critical steps for protecting your sensitive trading information.

Also, choose a tool that offers two-factor authentication to add an extra layer of security. It's equally important to verify that the provider performs regular security audits to ensure the system remains secure and reliable. These features are key to keeping your trading data safe across various platforms.