Looking for free tools to analyze stocks and funds? Here’s a quick guide to the best platforms that help you make smarter investment decisions - without spending a dime. These tools provide financial data, stock screening, market updates, and fund research.

Top Tools:

- Stock Analysis: Offers financial data on 5,500 stocks and 4,000 ETFs, with analyst ratings and screening tools.

- Koyfin: Great for market data visualization and global equity analysis, with historical data up to 30 years.

- Yahoo Finance: Combines real-time quotes, news, and basic charting in an easy-to-use platform.

- Finviz: Known for its advanced stock screening with 67 customizable criteria.

- Morningstar: Focused on fund and ETF research with performance data and ratings.

Quick Comparison:

| Tool | Stock Coverage | Key Features | Best For |

|---|---|---|---|

| Stock Analysis | 5,500 stocks, 4,000 ETFs | Financial statements, screening | Long-term strategies |

| Koyfin | 100K+ global securities | Advanced charts, macro data | Global market insights |

| Yahoo Finance | Extensive global coverage | Real-time quotes, news | Everyday market tracking |

| Finviz | 8,500 stocks and ETFs | 67 screening filters, heat maps | Visual stock screening |

| Morningstar | Global stocks & funds | Fund ratings, cost comparison | Mutual funds and ETF analysis |

Tip: Combine tools to cover all your needs - use Stock Analysis for metrics, Koyfin for visualizations, and Yahoo Finance for breaking news. Want deeper insights? Finviz and Morningstar can help refine your strategy.

5 Best Free Equity Research Tools

Stock Analysis: Financial Data Platform

Stock Analysis provides in-depth financial data on around 5,500 stocks and 4,000 ETFs traded in U.S. markets. It's a solid choice for investors focused on long-term strategies, offering tools that simplify fundamental analysis.

With the free version, you get access to:

- Financial statements

- Performance metrics

- Aggregated analyst ratings

- Screening tools

Koyfin: Market Data Visualization

Koyfin serves a large audience, including over 30,000 financial advisors and half a million investors. Its free tier is packed with features like advanced charting, macro dashboards, detailed financial snapshots for companies, and historical data spanning up to 30 years for select metrics.

"Koyfin is an excellent research tool and with its global coverage of equities, analyst estimates and financials, it allows investors to carry out fast and comprehensive analysis. Koyfin is a great product!" - Puru Saxena, Independent Investor

Yahoo Finance: News and Stock Data

Yahoo Finance combines market data with a seamless news integration, all wrapped in a user-friendly interface. It's a go-to resource for investors seeking a mix of fundamental data and news updates.

"Yahoo Finance is a great site for obtaining a variety of fundamental data about a company you are looking into. For this reason, it is a great site." - Markus Heitkoetter, Actively swing trading stocks and options

Notable free features include:

- Real-time quotes and basic charting

- Company financial statements

- Access to SEC filings

- Portfolio tracking tools

- Integrated news feed

For those seeking advanced screening capabilities, Finviz is a strong contender.

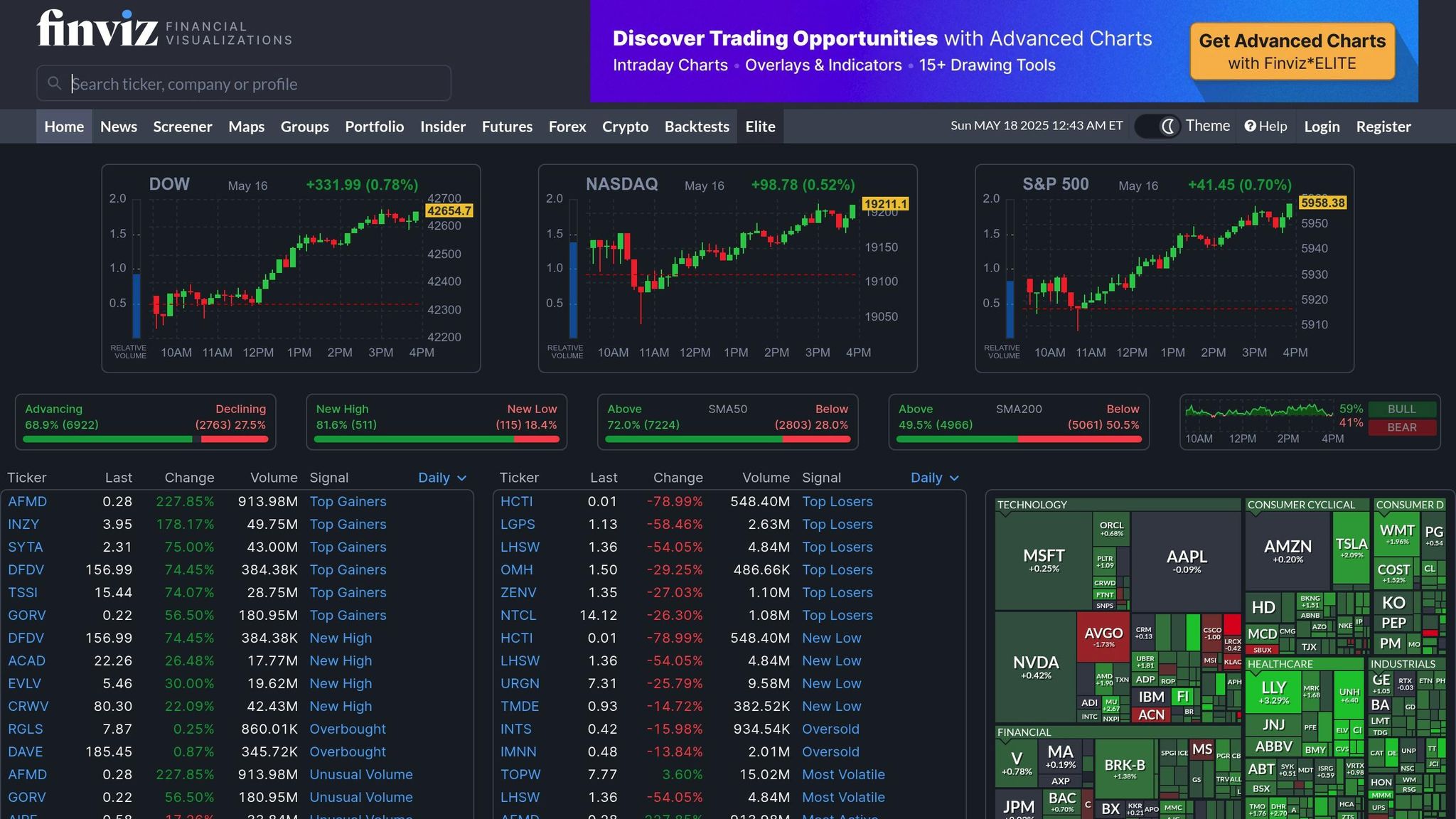

Finviz: Stock Screening Tools

Finviz excels in stock screening, covering 8,500 stocks and ETFs with over 60 customizable criteria. It's an excellent tool for narrowing down investment opportunities based on specific metrics.

Here’s a quick look at Finviz’s free features:

| Feature | Free Version Capabilities |

|---|---|

| Stock Coverage | 8,500 stocks and ETFs |

| Screening Filters | 67 fundamental and technical criteria |

| Data Updates | 3–5 minute delay |

| Portfolio Capacity | Up to 50 stocks |

| Screener Presets | Maximum 50 |

Next up, we’ll dive into Morningstar’s fund research tools.

Morningstar Investor: Fund Research

Morningstar stands out for its unbiased, data-driven approach to fund and ETF analysis. It's a trusted resource for investors looking to evaluate funds without distractions.

"Our analysts follow data, not market noise, to cover investments fairly, accurately, and from the investor's point of view, so you can make decisions free from distractions." - Morningstar Investor

Free features include:

- Fund performance data

- Cost comparison tools

- Access to fund ratings

- Portfolio analysis tools

- Economic news updates

The top 4 stock research tools that are free to use

Tool Features Comparison

Choosing the right free equity research tool means knowing what each one brings to the table.

Feature Comparison Table

Here’s a breakdown of the key features offered by the free versions of popular equity research tools:

| Feature | Stock Analysis | Koyfin | Yahoo Finance | Finviz | Morningstar |

|---|---|---|---|---|---|

| Stock Coverage | 5,500 stocks, 4,000 ETFs | 100K+ global securities | Extensive global coverage | Broad stock and ETF data | Global stocks and funds |

| Screening Filters | Comprehensive screening options | Advanced filtering features | Basic filters | 67 criteria | Basic fund filters |

| Charts | Advanced technical charts | Interactive charts with macro data | Customizable charts | Visual mapping tools | Basic performance charts |

| Watchlist Capacity | Up to 5 watchlists | Unlimited | Unlimited | Limited | Basic tracking |

| Financial Statements | Full access to financial data | Key financial metrics | Full access | Limited details | Fund-focused data |

This table helps clarify which tools align with your specific requirements, making it easier to choose the right one for your investment goals.

Platform Overviews

Stock Analysis stands out with its detailed financial data for both stocks and ETFs, designed for quick and accurate insights.

Koyfin offers a global perspective with powerful visualization tools, ideal for interpreting complex data.

Yahoo Finance combines an intuitive interface with integrated market news, making it a go-to for everyday market tracking.

Finviz excels in visual screening, offering a wide range of criteria for efficient filtering.

Morningstar focuses on fund and ETF research, providing reliable, fund-centered analysis in its free version.

Each platform has its strengths, whether you need in-depth stock data, global visualization, integrated news, or visual screening tools. Use this comparison to identify which tool best fits your investment strategy and analysis needs. These insights will pave the way for effectively incorporating these tools into your market monitoring process in the next section.

sbb-itb-2e26d5a

Using Free Tools Effectively

Combining Multiple Tools

You can boost your research efficiency by strategically combining free tools into a seamless workflow. Start with Stock Analysis as your go-to resource for financial data. Covering 5,500 stocks and 4,000 ETFs, it provides a wealth of fundamental metrics and analyst ratings to kick off your research.

Next, use Koyfin for its powerful visualizations and data presentation. It’s an excellent way to broaden your market perspective. To round things out, turn to Morningstar for in-depth fund research, especially when evaluating ETFs and mutual funds. Together, these tools create a complete approach to analyzing both individual stocks and funds.

Once you’ve built this robust multi-tool strategy, shift your attention to monitoring the market in real-time.

Market Monitoring Strategies

After establishing a strong research foundation, it’s time to keep a finger on the market’s pulse. Tools like Finviz can help you start your day right. Use their market maps to quickly identify sector trends and movements, and leverage their screening tools to uncover potential investment opportunities.

Investor Stephen Chen highlights the value of Koyfin for market monitoring:

"Koyfin is one of the chief tools I use to get a quick overview of the markets, as it offers a great dashboard covering multiple asset classes across the globe. And because they also offer data and analysis on US-listed ETFs and funds."

For breaking news and price updates, Yahoo Finance is an essential addition. Its real-time updates and basic analysis tools help you stay informed about market-moving events and their potential impact on your portfolio.

Free vs Paid Tool Selection

While free tools offer a wealth of functionality, there may come a time when upgrading to paid services makes sense. If your portfolio grows or you need advanced features like deeper historical data, real-time updates, or more sophisticated screening, paid options could be worth exploring.

For example, services like YCharts Standard (priced at $3,600 per year) or Koyfin Plus ($39 per month) provide expanded capabilities. However, most individual investors will find that a combination of free tools - like Stock Analysis and Finviz - meets their needs.

Even Koyfin’s free version, trusted by over 500,000 investors, offers comprehensive market coverage. As Koyfin states:

"To equip every investor in the world, no matter their size, with the best data and tools; empowering them to achieve more."

For a deeper dive into these and other equity research tools, check out the detailed directory available at Best Investing Tools Directory.

Summary

Free equity research tools provide investors with the resources they need to make smarter decisions. Platforms like Stock Analysis offer detailed financial data and analyst ratings, while Koyfin stands out with its budget-friendly, advanced market visualization tools.

For a well-rounded approach to fundamental analysis, consider combining multiple tools: rely on Stock Analysis for critical metrics, Koyfin for tracking market trends, Morningstar for in-depth fund research, Finviz for stock screening, and Yahoo Finance for up-to-date market news. Together, these tools create a strong foundation for crafting an effective investment strategy.

While premium options such as Koyfin Plus ($39/month) and Stock Analysis Pro ($9.99/month) unlock additional features, many individual investors can create a powerful research workflow using free tools. For detailed reviews, check out the Best Investing Tools Directory.

Access to quality data is key for successful investing. Fortunately, many online brokers now include professional-grade equity research and advanced charting tools at no extra cost. By strategically using these free resources, investors can develop a comprehensive research process that competes with paid alternatives.

FAQs

What’s the best way to combine free equity research tools to improve my investment strategy?

To make the most of free equity research tools, it's smart to combine resources that focus on different aspects of analysis. For instance, you can turn to Yahoo Finance for stock data and the latest news, TradingView for advanced charting features, and MarketBeat for analyst ratings and price targets. Using multiple tools like these allows you to cross-check details and get a broader perspective on potential investments.

Consider adding tools like Koyfin for detailed financial metrics and Portfolio Visualizer to assess how your portfolio is performing. By mixing and matching these resources, you'll be better equipped to spot trends, evaluate stocks effectively, and make well-informed decisions - all while minimizing the risk of relying too heavily on a single source.

What’s the difference between free and paid equity research tools, and how do I know if I should upgrade?

Free equity research tools are a great starting point, offering features like basic financial data, simple charts, and limited analysis capabilities. However, paid tools take things up a notch by providing advanced perks such as real-time updates, extensive datasets, detailed analytics, and exclusive reports - perfect for those who take investing seriously.

If you find that free tools no longer cut it - maybe because you're managing a larger portfolio, using complex strategies, or need faster and more detailed insights - it might be time to consider upgrading. Paid options can also be a smart move if you depend on premium features like customizable dashboards or expert-level analysis to make informed decisions.

What is the best free tool for staying updated with real-time market news?

For staying on top of real-time market news and updates, Yahoo Finance stands out as a go-to platform. It delivers up-to-the-minute market data, breaking news, and essential insights to keep investors in the loop. Plus, its straightforward interface makes tracking stock performance and accessing detailed financial details a breeze.

Other solid choices include MarketWatch, offering a wide array of financial news and in-depth analysis, and Koyfin, which is praised for its customizable dashboards and data visualization features. These platforms are excellent for investors looking for timely, trustworthy information to guide their decisions.