Equity research platforms are tools that provide in-depth stock analysis, market data, and investment recommendations. They are essential for navigating the complexities of global markets, offering insights into companies, industries, and trends. These platforms are used by institutional investors, individual traders, and corporate teams for decisions like portfolio management, competitive analysis, and strategic planning.

Key Takeaways:

- Why They Matter: They simplify global investing by addressing fragmented data, regulatory differences, and coverage gaps, especially for underrepresented markets.

- Common Challenges: Limited analyst coverage for small companies, underutilized research reports, and the need for better tools to process vast amounts of data.

- Top Features to Look For:

- Real-time market data and news

- Advanced charting and technical analysis tools

- Financial analysis and valuation models

- Integration with existing systems and export options

- Top Platforms:

- Quodd: Focuses on real-time, customizable data feeds for institutions.

- Morningstar Direct: Offers tools for portfolio analysis, private investments, and global market insights.

- GuruFocus: Tailored for value investors, with screening and portfolio tracking tools.

Quick Comparison

| Platform | Strengths | Best For | Real-Time Data | Technical Tools | Financial Analysis Tools |

|---|---|---|---|---|---|

| Quodd | Data delivery, customization | Institutions, fintech firms | Yes | Limited | Limited |

| Morningstar Direct | Portfolio analytics, research | Asset managers, long-term investors | Yes | Yes | Yes |

| GuruFocus | Value investing tools | Individual investors, analysts | Yes | Yes | Yes |

When choosing a platform, consider your investment goals, the depth of analysis needed, and how well the tool integrates into your workflow. Each platform caters to different needs, so weigh features against your priorities.

Discover the Best Research Platforms For Investors in 2025

Must-Have Features in Equity Research Platforms

The best equity research platforms combine speed, in-depth analysis, and user-friendly tools to help investors navigate the complexities of global markets.

Real-Time Data and Market News

In fast-moving markets, even millisecond-level price changes can make a difference. Top-tier platforms provide instant updates on price movements, trading volumes, and market sentiment, enabling investors to act quickly and strategically across different time zones and regulatory environments.

For global investors, staying informed about economic updates, corporate earnings, and breaking news is non-negotiable. Real-time data feeds allow traders to seize short-term opportunities while enhancing risk management through precise stop-loss orders and improved transparency . These instant updates lay the groundwork for the advanced tools discussed below.

Charting and Technical Analysis Tools

Advanced charting transforms raw data into actionable insights. Leading platforms feature customizable chart types - such as candlestick, line, and bar charts - alongside technical indicators like moving averages, RSI, MACD, and Bollinger Bands, which can be layered for deeper analysis.

Multi-timeframe analysis is a game-changer for global investors. The ability to switch between intraday, daily, weekly, and monthly views supports flexible decision-making tailored to different investment horizons and trading patterns. This adaptability is especially useful in navigating the variability of international markets.

Comparing multiple securities on one chart is another key feature. It helps investors evaluate relative performance across markets, sectors, or individual stocks, making it easier to identify diversification opportunities. These tools naturally complement the financial and valuation analysis capabilities that follow.

Financial Analysis and Company Valuation Tools

Access to detailed financial data sets professional platforms apart from basic tools. Leading platforms provide comprehensive financial statements, key ratios, and analysis tools that cater to various accounting standards and currencies.

Many platforms also include a vast library of analyst research reports - some offering up to 40 million reports from global providers. This extensive coverage ensures investors can access insights on companies in both developed and emerging markets.

As the volume of financial data grows, automated tools have become indispensable. AI-powered features can quickly process large datasets, highlighting critical insights and allowing investors to focus on the most relevant information.

Valuation modeling tools, such as DCF calculators, comparable company analysis, and precedent transaction analysis, are particularly useful for international investments. These tools account for differences in reporting standards and currency fluctuations, ensuring their utility across global markets.

Data export functionality is another must-have. Whether building custom models or integrating platform data into existing systems, seamless export options ensure that research remains accessible and practical.

Premium content access further enhances top platforms. For instance, some platforms offer an Expert Transcript Library with over 150,000 transcripts of conversations with industry specialists. This resource is especially valuable for international markets, where local knowledge can significantly impact investment decisions.

Leading Equity Research Platforms for Global Markets

The platforms highlighted here represent the forefront of global equity research, each offering distinct strengths tailored to the needs of institutional investors, financial advisors, and individual traders exploring international markets.

Quodd

Quodd stands out for its customizable and modular market data solutions, delivered through the QX Digital Platform. This platform integrates real-time, historical, and reference data via flexible APIs, serving over 1,900 institutions worldwide. In 2024, the platform saw a nearly 200% rise in institutional access, with its QX Marketplace processing more than 9 trillion API requests - a 38% increase compared to the previous year.

Quodd provides coverage across global equities, funds, and ETFs, supporting various security identifiers. Its data feeds are accessible around the clock, making it a reliable choice for both large institutions and smaller startups looking for robust market data solutions.

"At QUODD, our driving principles define how we operate and innovate: a commitment to excellence, fostering open communication, uniting as a team, designing solution-driven products, and maintaining a steadfast client-centric approach."

While Quodd’s strength lies in its data delivery and customization, Morningstar Direct takes a broader approach, offering a suite of research and analytics tools for diversified portfolios.

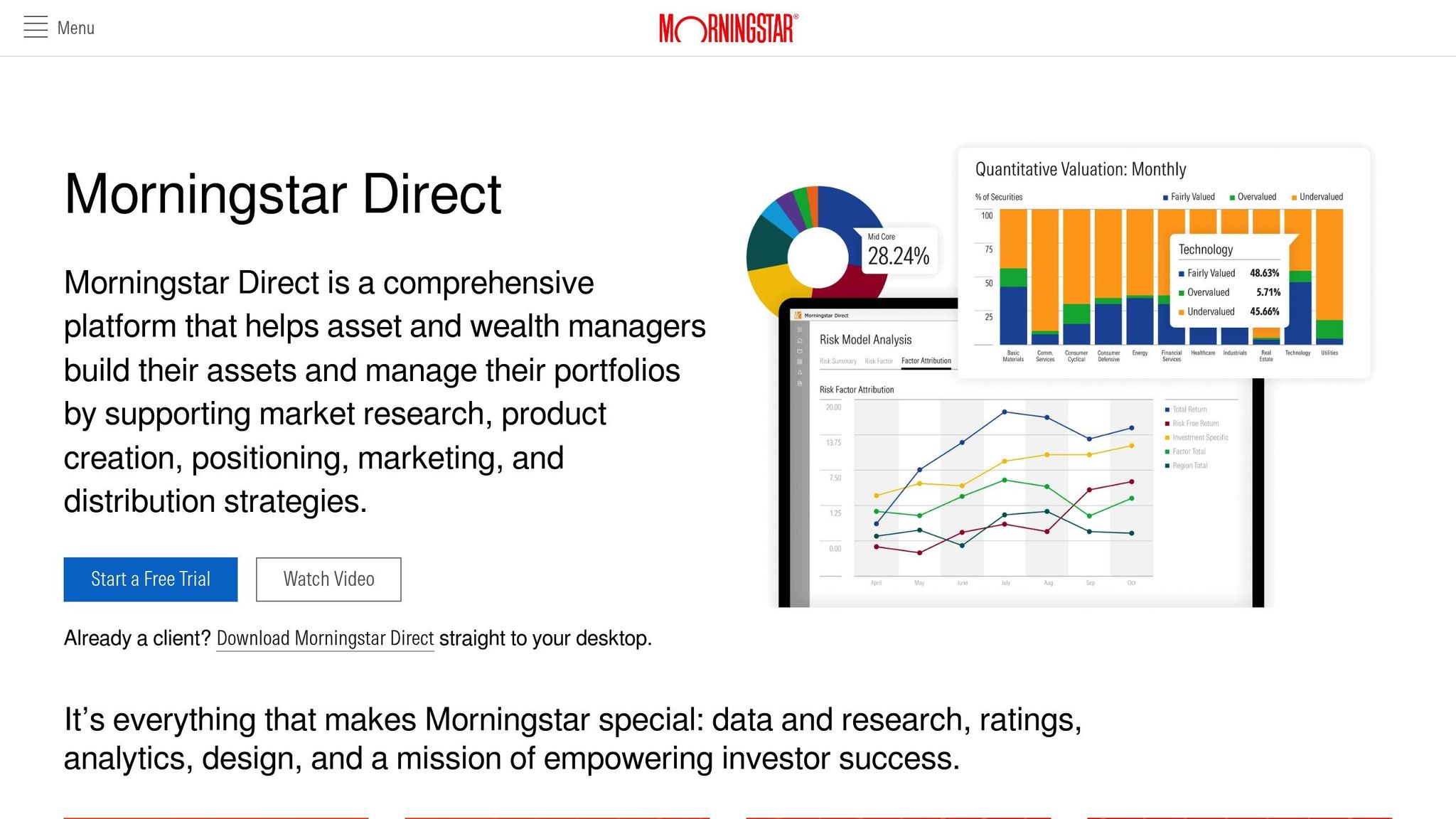

Morningstar Direct

Morningstar Direct is a comprehensive research and analytics platform tailored for asset and wealth managers. It supports market research, product development, portfolio management, and investment reporting. The platform provides independent insights into managed investment products, publicly listed companies, private capital markets, debt securities, and real-time global market data.

Operating in 32 countries, Morningstar Direct balances regional relevance with a global framework, ensuring its insights are actionable across different markets. In June 2025, the platform introduced updates to its Direct Advisory Suite, designed to help financial advisors incorporate private investments into client portfolios. These updates include expanded research, enhanced risk profiling, portfolio transparency tools, and an alternative investments hub. This move aligns with findings from Morningstar’s 2025 Voice of the Investor study, which revealed that 25% of retail investors already hold private equity investments - a figure rising to 35% among those with $500,000 or more in investable assets.

Kunal Kapoor, Morningstar’s CEO, emphasizes:

"Morningstar's universal language of investing has helped advisors and investors bring clarity to complexity for decades. As private investments become part of more investor portfolios, we're extending that language to help bring the same comparability and confidence to private markets that we've delivered for investors in public markets."

James Gard, Editor at Morningstar, adds:

"Our regional expansion goes beyond just language. Our team in each market harnesses Morningstar's extensive data and research coverage of global investments, adapting it to the financial realities and preferences of local investors. This makes our research both relevant and actionable, no matter where investors are located."

Morningstar Direct also offers tools for analyzing private investments within broader portfolios, such as risk profiling and transparency features. For academic audiences, the platform is accessible through the CBS Library Data Lab.

While Morningstar Direct provides a broad analytical framework, GuruFocus narrows its focus to value investing and portfolio tracking, catering to a specific investment philosophy.

GuruFocus

GuruFocus is designed for international value investors, offering tools for stock screening and tracking the portfolios of successful investors. It serves a diverse audience, including individual investors, fintech developers, and corporate research teams.

The platform excels in fundamental analysis, allowing users to explore investment opportunities systematically. Its screening tools enable filtering by various fundamental criteria, making it easier to identify potential investments. GuruFocus combines a user-friendly interface with the depth needed for professional-level research, making it a valuable resource for investors seeking to refine their strategies.

Together, Quodd, Morningstar Direct, and GuruFocus demonstrate distinct approaches to global equity research, catering to a wide range of market participants.

sbb-itb-2e26d5a

Platform Comparison: Features, Benefits, and Pricing

After reviewing essential features, let’s dive into a comparison of two key platforms - Quodd and Morningstar Direct - to help you identify which one aligns best with your investment needs.

Feature and Market Coverage Comparison

Quodd stands out for its strong focus on data delivery and customization. It leverages the cloud-based QX Digital Platform to provide global pricing and reference data. With its customizable data feeds, Quodd ensures organizations have continuous, real-time access to critical market information.

Morningstar Direct, on the other hand, offers a powerful suite of analytical tools tailored for institutional investors. It combines market data, fund performance metrics, and risk analysis into a single platform. Key features include:

- Direct Lens: Tools for portfolio creation and analysis.

- Data Feeds: Comprehensive access to market data.

- Presentation Studio: Custom-branded reporting capabilities.

- Report Portal: Templates for strategy-aligned investment reports.

Additionally, Morningstar Direct supports style analysis, peer comparisons, and performance evaluations, making it a robust solution for in-depth analysis.

| Platform | Primary Strength | Global Coverage | Real-Time Data | Technical Analysis | Fundamental Analysis |

|---|---|---|---|---|---|

| Quodd | Data Infrastructure | ✓ | ✓ | Limited | Limited |

| Morningstar Direct | Comprehensive Analytics | ✓ | ✓ | ✓ | ✓ |

This table highlights the distinct strengths of each platform: Quodd excels in delivering real-time data and infrastructure, while Morningstar Direct is a go-to for advanced analytics and portfolio management.

Pricing Plans and Cost Analysis

The pricing strategies of these platforms reflect their unique market focus and feature sets:

- Quodd: Offers flexible, customizable pricing options, allowing organizations to tailor data packages to meet their specific needs.

- Morningstar Direct: Positioned as a premium solution, Morningstar Direct does not offer free trials or versions. Pricing is typically customized for enterprise clients, reflecting its extensive data coverage and analytical capabilities.

Best Platform Matches for Different Investor Types

Choosing the right platform depends heavily on your specific investment goals, organizational needs, and budget constraints. Here’s how these platforms align with different user profiles:

- Institutional Investors and Asset Managers: Morningstar Direct is particularly well-suited for these users. For example, a financial services professional from a mid-sized firm (11–50 employees) noted that they used Morningstar Direct daily for 6–12 months, praising its ability to consolidate and analyze data comprehensively. However, they also mentioned the platform’s steep learning curve and complex interface.

- Technology Firms and Fintech Developers: Quodd’s customizable data feeds make it an excellent choice for organizations building proprietary tools or integrating data into their systems. Its robust infrastructure ensures reliable, real-time data delivery.

- Short-Term Traders: These users may need to explore other platforms that focus on advanced charting and real-time trading features, as neither Quodd nor Morningstar Direct specializes in these areas.

- Long-Term Investors: Those looking for deep company research and valuation tools might find Morningstar Direct more aligned with their needs.

Ultimately, the best platform depends on factors like the complexity of analytics required, the size of the user base, and budget considerations.

How to Select the Right Equity Research Platform

Choosing the right equity research platform means aligning your investment needs, workflow, and long-term goals with the platform's features and capabilities.

Checking Data Quality and Research Depth

The quality of data is the backbone of any successful investment strategy. When evaluating platforms, pay attention to the reliability of their data sources, how often they update, and the methods they use for analysis. Interestingly, over 80% of investment professionals now incorporate alternative data sources, moving beyond traditional financial statements and management commentary.

Many top platforms offer expanded datasets, providing a wider range of information to uncover insights into company performance. Environmental, Social, and Governance (ESG) factors have also become a key consideration, with 65% of institutional investors now including ESG metrics in their valuation models. Additionally, firms that use artificial intelligence tools have reported a 40% increase in research productivity and a 25% improvement in forecast accuracy.

When assessing a platform, look for depth in areas like industry analysis, management evaluations, and historical data. Modern analysts are spending more time generating insights rather than gathering data - a shift made possible by platforms that prioritize robust data offerings.

Once you've ensured the platform provides high-quality data, the next step is to evaluate its user interface and integration features.

User Interface and System Integration

A well-designed user interface isn't just a nice-to-have; it's essential for efficient workflows and daily usability. A clean, intuitive interface can significantly improve productivity and even boost conversion rates.

Avoid platforms with cluttered designs or unnecessary features. Instead, prioritize those with consistent layouts that highlight key information and provide immediate feedback. Consistency across devices is also crucial, ensuring you can access vital data whether you're at your desk or working remotely.

System integration is another critical factor. The platform should work seamlessly with your existing databases, portfolio management tools, and reporting systems. Features like customizable dashboards and alert systems allow you to tailor the platform to fit your specific needs.

For example, a mid-sized financial services firm that revamped its platform's interface and navigation saw a 25% increase in online transactions and a 15% rise in customer satisfaction within six months. This highlights the tangible benefits of a user-friendly design.

Using Best Investing Tools Directory for Platform Research

Once you've reviewed data quality and interface design, take advantage of comprehensive tool directories to deepen your research. The Best Investing Tools Directory is an excellent resource for comparing equity research platforms. It includes unbiased reviews from real users and detailed evaluations of tools focused on areas like technical analysis, charting, and financial modeling.

This directory organizes tools by type, making it easier to identify platforms specializing in features such as real-time market data, advanced analytics, or financial modeling. Before diving into comparisons, clarify your analytical needs and prioritize platforms with strong capabilities in the areas that matter most to you.

The directory also offers filtering options to help narrow down choices. You can search for platforms with features like generative AI, semantic search, sentiment analysis, or premium content access. Keep in mind that many firms rely on multiple tools, as each platform brings unique strengths to the table. Use the directory's comparison features to evaluate how various platforms measure up in terms of data analysis, financial modeling, and integration with your existing systems. This approach ensures you're making a decision based on clear, side-by-side comparisons rather than marketing buzzwords.

Key Points for Investors

When diving into global markets, choosing the right equity research platform can significantly influence your investment outcomes. Here are some critical factors to keep in mind as you refine your investment strategy.

Focus on data quality and advanced tools. Look for platforms that offer AI-driven financial analysis, intent-aware semantic search, and real-time market alerts. These features are becoming indispensable, with many investors now leveraging sentiment analysis and alternative data sources beyond traditional financial reports to gain an edge.

Consider market adoption as a benchmark. The popularity of a platform can speak volumes about its reliability. For example, 88% of S&P 500 companies and 80% of top asset management firms use AlphaSense for their research. This widespread usage highlights its ability to deliver insights that lead to smarter investment decisions.

Integration capabilities matter. Efficiency in your workflow can be greatly improved by platforms that allow data export into your existing systems and offer customizable dashboards. Centralizing multiple data sources in one place not only simplifies operations but also reduces the chances of missing crucial information.

Pay attention to ESG and regulatory needs. As Environmental, Social, and Governance (ESG) considerations gain prominence, platforms that provide robust ESG analysis are increasingly valuable. With growing regulatory oversight pushing for transparency and reducing conflicts of interest, having tools that align with these priorities is essential.

Weigh cost-effectiveness against your needs. Premium platforms often come with advanced features, but it’s important to evaluate whether these align with your specific investment goals. Keep in mind that over 70% of trading on U.S. stock exchanges now involves algorithmic trading, underscoring the need for access to high-quality, real-time data to stay competitive.

For additional comparisons and insights, explore the Best Investing Tools Directory to find platforms that suit your research needs.

FAQs

How do Quodd, Morningstar Direct, and GuruFocus differ, and which one is right for my investment goals?

Quodd delivers real-time global market data and tailored data solutions, making it an excellent choice for institutions that require up-to-the-minute updates. Morningstar Direct provides investment research and portfolio management tools, catering to the needs of long-term investors and financial advisors. GuruFocus focuses on value investing insights, offering stock analysis and strategies inspired by successful investors.

When deciding on a platform, think about what matters most to you: choose Quodd for real-time data, Morningstar Direct for detailed analysis and portfolio tools, or GuruFocus for value investing and stock research.

How can equity research platforms work with my existing tools, and what should I look for to ensure smooth integration?

Equity research platforms frequently connect with existing tools using APIs, data connectors, or by working with systems like CRMs, fund accounting software, and other third-party apps. These connections simplify processes and help maintain consistent data across different platforms.

For smooth integration, prioritize features such as API support, strong data security measures, and the platform's ability to align with your specific workflows. It's also important to verify compatibility with your current tools and ensure the platform allows enough customization to suit your requirements.

How do AI-powered tools and alternative data improve equity research platforms?

AI-powered tools are transforming equity research platforms by introducing real-time sentiment analysis, predictive modeling, and automated financial modeling. These capabilities allow investors to sift through massive datasets efficiently, uncovering trends and opportunities that might slip through the cracks with older, more manual approaches.

On top of that, alternative data sources like consumer behavior patterns or satellite imagery offer insights that go beyond the scope of traditional financial reports. By incorporating these unconventional data points, investors can sharpen their strategies and make decisions with greater precision and confidence.